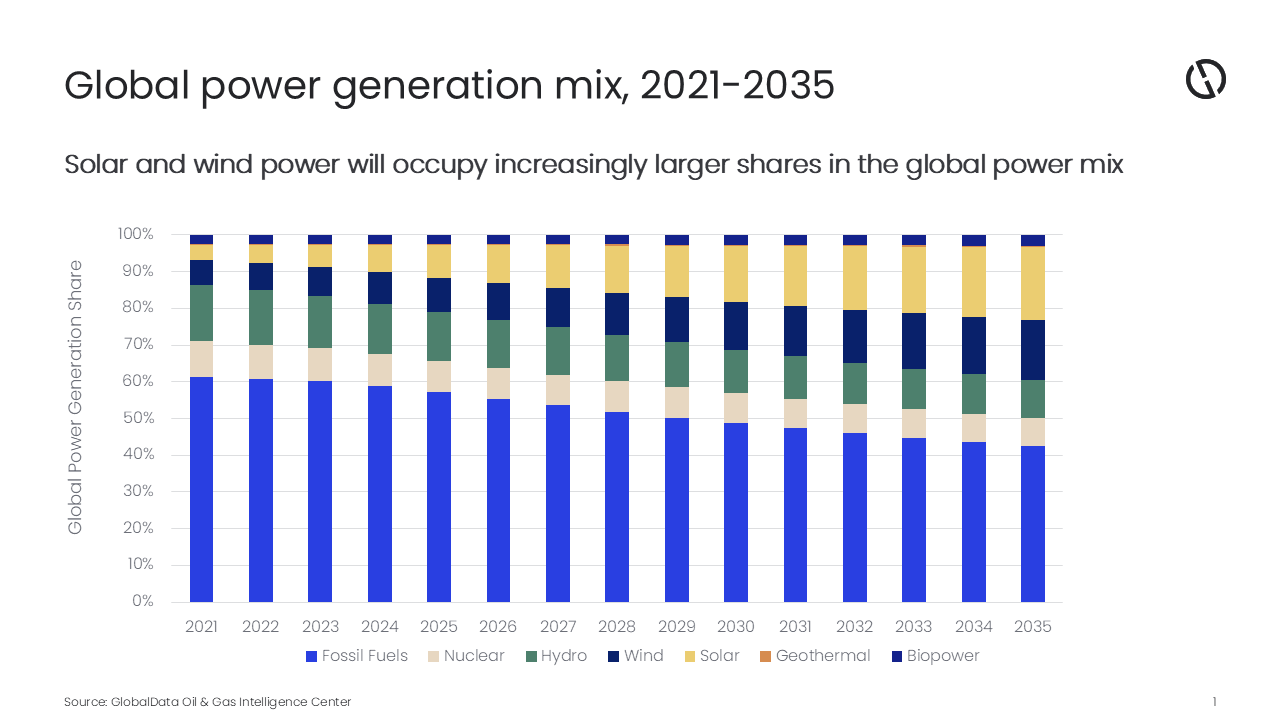

The oil and gas industry enters 2026 facing a marked change in momentum regarding the energy transition. Despite recurring climate-related catastrophes—such as record-breaking wildfires, extreme heatwaves—and ongoing calls for emission reductions, the pace of the global energy transition is faltering. Energy-related CO₂ emissions continue to reach new highs, underscoring the persistent dominance of fossil fuels in the world’s energy mix, says GlobalData.

GlobalData’s Strategic Intelligence report, Energy Transition in Oil & Gas, highlights that major oil and gas companies remain committed towards reducing their carbon footprint as part of a shift toward lower-carbon business models. However, even as many firms maintain net-zero ambitions for 2050 and interim targets for 2030, their strategies have grown increasingly cautious, shaped by volatile market and policy conditions.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “In the past 12 to 18 months, the industry’s much-publicized energy transition push has remained largely at the stage of early discussions and limited pilot projects, rather than materializing at scale. The post-2022 energy disruption and related supply concerns have dampened the sector’s appetite for radical change to the energy mix. BP, for example, has now directed greater investments into upstream oil and gas, divested some of its upcoming renewable power projects, and lowered the near-term emissions goals.

“Similarly, Shell halted construction of its Rotterdam renewable fuels plant, citing a weak market outlook. BP and Shell’s renewed focus on financial discipline and value from conventional business mirrors a broader sector trend.”

Leading oil and gas players continue to work towards decarbonization goals they have set, often relying on existing and emerging technologies. Investment in renewable power, especially wind and solar, continues, but with hesitation.

Puranik continues: “The initial hype around the global energy transition has subsided in 2025. Profitability issues, inflation, and the withdrawal of government incentives in major markets, such as the US, have raised uncertainties around renewable projects.”

Carbon capture is increasingly used to mitigate emissions, while companies are also exploring hydrogen, renewable power, and low-carbon fuels as alternatives. Batteries and other energy storage are being investigated as additional avenues. Yet, 2025 has ushered in a period of strategic retrenchment. Major players are scaling back renewables, prioritizing traditional oil and gas, and emphasizing financial prudence. Rather than accelerate transition plans, most firms now opt for a measured approach to balance risk.

Puranik concludes: “Financial prudence and energy security are guiding decisions. While innovation continues, today’s transition is more incremental and pragmatic, and the rollout of large-scale low-carbon projects is still closely tied to market and policy evolution.”

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer