Extreme weather is becoming an increasingly disruptive force for European supply chains, with ports, inland transport and logistics networks showing growing vulnerability to short-notice shutdowns. As climate-related events intensify, the knock-on effects are extending well beyond immediate safety concerns, feeding directly into delays, cost pressures and uncertainty for industrial markets reliant on just-in-time delivery. Will Beacham looks at Storm Leo’s impact on Spain and Portugal highlights how quickly weather disruption can cascade across Europe’s shipping and chemicals markets

Storm Leo has brought high winds and torrential rain across large parts of Spain and Portugal, forcing ports and shipping companies to suspend operations.

The severe weather system hit the region on Tuesday 3 February and is expected to persist until Saturday 7 February, with wind and up to a year’s worth of rain forecast in 24-hours affecting areas already saturated by Storm Kristin just a week earlier.

On Thursday morning winds speeds reached 30-40 metres per second (m/s), equal to 108-144 kilometres per hour and approximately 67-89 miles per hour.

Source: European Centre for Medium-Range Weather Forecasts (ECMWF)

Authorities in Spain and Portugal issued travel and weather warnings as emergency services moved into action in areas affected by flooding and severe wind.

Shipping group Maersk said weather conditions had deteriorated beyond initial expectations, forcing it to stop ships leaving their berths in the affected area from the evening of 3 February until conditions improve, with terminals also staying closed for longer than previously anticipated.

“This unfortunately also means that vessel schedules will be further delayed, again impacting operations in the Western Mediterranean, Northern Europe and beyond,” the group added.

Logistics group Kuehne+Nagel reported that the ports of Gibraltar and Algeciras suspended operations due to severe wind and rain affecting southern Spain, with improvement expected by Friday, 6 February.

Transport disruption has extended inland as well, it added. In Portugal, vessels were skipping scheduled port calls, and rail services are interrupted.

Logistics delays are impacting chemical markets. A European polyols buyer told ICIS that a producer is delaying its order by 1-1.5 weeks, blaming logistics disruption.

Strike action, freezing weather hits Europe

In Spain, rail transport unions strike action is expected to continue over safety standards following a spate of rail accidents in recent weeks.

In Germany there are reports that Verdi, which represents nearly 100,000 transport workers, called a strike on Monday 2 February, with more industrial action planned over working conditions.

The strike took place as freezing weather conditions affected large parts of Germany, central and eastern Europe.

Further afield, sources state that Morocco is facing significant logistical disruption following heavy rainfall and port closures, leading to a mounting backlog in phosphate fertilizer shipments.

OCP’s main export port is now understood to be closed until at least 10 February, effectively halting outbound shipments for the coming weeks.

OCP did not respond to a request for comment on the report.

Gemini adds Suez service to Europe

Maersk and Hapag-Lloyd are rerouting of one of their shared services under the Gemini Cooperation, transitioning it through the Red Sea and the Suez Canal, with all transits secured by naval assistance.

The ME11 service connects India and the Middle East with the Mediterranean. From mid-February, the Suez route will be implemented on westbound sailings with the vessel Albert Maersk and on eastbound sailings with Astrid Maersk.

In a statement published on 3 February, Maersk said Gemini plans to add further services if the area is safe for shipping.

“Any alteration to the Gemini service will remain dependent on the ongoing stability in the Red Sea area and the absence of any escalation in conflicts in the region,” it added.

Insurance premiums are understood to be elevated for shipments, and may rise further as geopolitical tensions in the Middle East remain high.

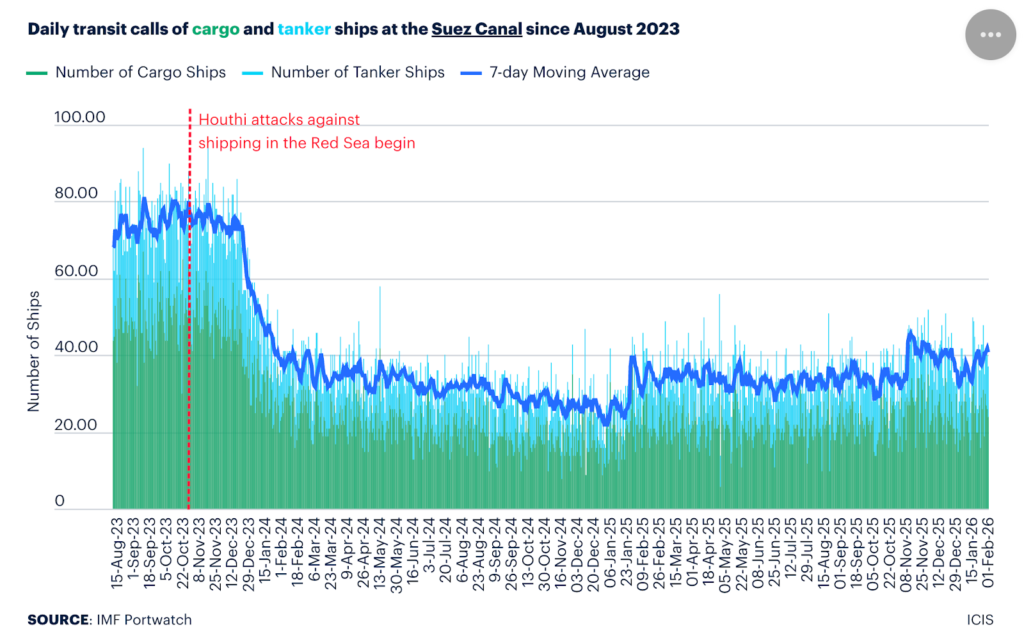

Reopening of the Suez Canal has not yet resulted in any significant pick up in traffic.

Will Beacham is Deputy Editor, Chemical Business at ICIS, the independent commodity intellience service. Additional reporting by Chris Vlachopoulos, Tom Brown, Zubair Adam, Marta Fern and Anne-Sophie Briant-Vaghela.

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer