India’s crude diversification marks a structural shift from opportunistic discount buying to disciplined geopolitical risk management. With oil accounting for roughly a quarter of primary energy consumption and import dependence near 87% in 2024, prioritising compliance resilience, supply optionality, and stronger US linkages signal a more strategic energy security doctrine, according to GlobalData.

Rising demand widens import exposure

India is the world’s third-largest oil consumer. The International Energy Agency (IEA) projects India’s oil demand to increase from 5.5 million barrels per day (mbpd) in 2024 to 8 mbpd by 2035, with import dependence projected to rise to 92% by 2035 even as domestic exploration efforts continue.

Arnab Nath, Associate Project Manager of Economic Research at GlobalData, comments: “This widening gap is pushing India to broaden its supplier base and reduce exposure to concentrated supply corridors and politically constrained barrels.”

US and Venezuela re-enter

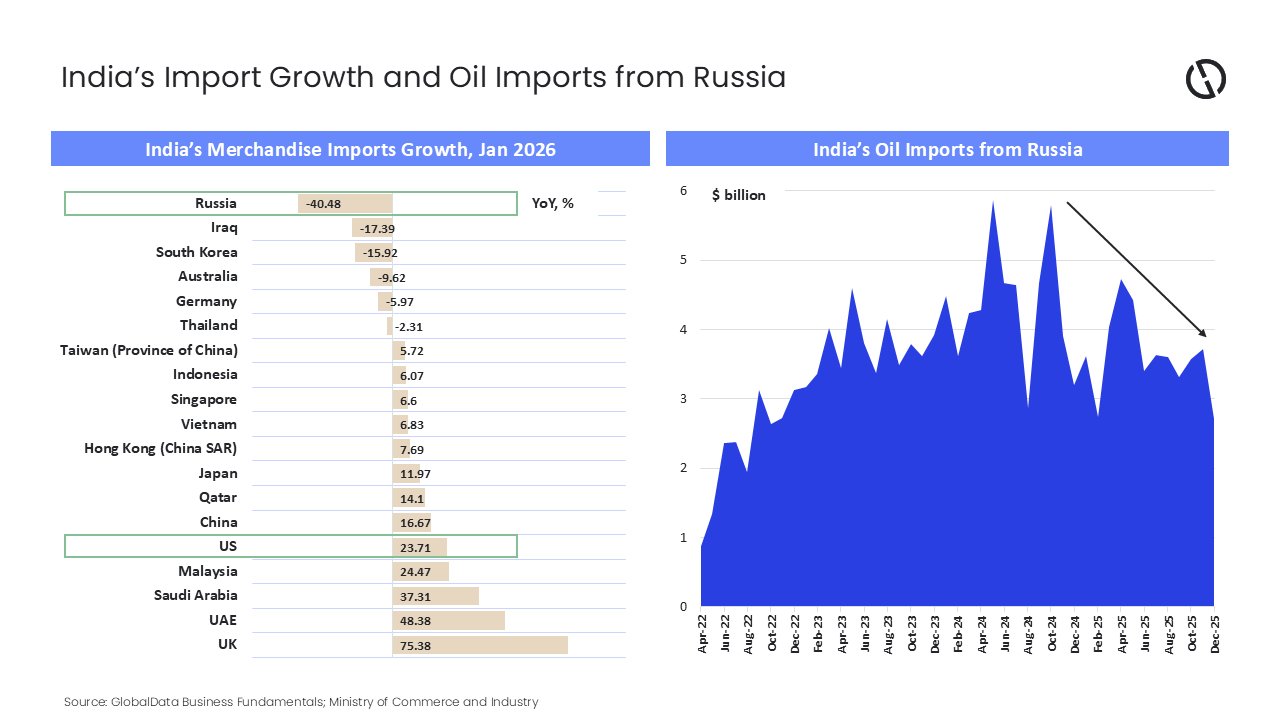

India’s crude mix has shifted sharply since 2022. Russia’s share surged from 2.7% before the Ukraine war to 25.9% in 2024, driven by discounted barrels. However, tightening trade and sanctions dynamics have triggered a reversal, with imports from Russia falling over 40% year-on-year in January 2026 amid declining crude purchases.

At the same time, Venezuela is re-emerging as a supplementary supplier, with Indian refiners securing fresh cargoes for key refineries. Yet volumes are likely to remain limited due to heavy, sour grades and constrained Venezuelan output. The shift is also influenced by US tariff threats linked to Iran trade, positioning Venezuela as a tactical alternative within India’s broader strategy to rebalance geopolitical risk exposure.

Nath explains: “India’s recalibration away from Russian crude is expected to ease immediate India–US friction and create space for deeper cooperation on LNG, critical minerals, and clean‑tech supply chains. However, it will not translate into automatic strategic alignment as New Delhi will continue to prioritize price and supply security, keeping optionality across suppliers, including the Middle East and selective sanctioned-origin barrels where feasible.

“For Washington, the shift validates tariff-and-sanctions leverage, increasing the likelihood of energy becoming a recurring negotiating instrument. The relationship will remain transactional on oil, but structurally convergent on long-term energy transition, grid modernisation, and nuclear collaboration.”

Discount capture to compliance focus

Following the India–US trade agreement announced on 02 February 2026, India has stronger incentives to de-risk its crude slate from sanctions exposure and tariff escalation, while maintaining access to competitive barrels. The US had imposed an additional 25% tariff in August 2025 tied to Russian oil purchases, and further increases were repeatedly threatened. Diversifying towards the US and selectively towards Venezuela supports India’s objectives of stabilising import costs, protecting export competitiveness, and sustaining broader strategic cooperation with the West, without abandoning its long-standing principle of energy sourcing based on market conditions.

Nath concludes: “India’s crude strategy is evolving from opportunistic discount capture to a more structured approach to manage geopolitical risk. After the deal, refiners are optimizing for compliance resilience and supply continuity. Russia may remain part of the mix when the economics work, but the direction is clear. India is moving toward a wider supplier base, anchored by stronger US energy linkages, alongside selective re-entry of sanctioned-origin alternatives where feasible.”

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer