While organisations, particularly in the energy, utilities, and resources (EUR) industry, are adopting AI today, they are not fully prepared for its full implementation. This has created what IFS, a leading provider of Industrial AI software, calls the ‘AI Execution Gap.’

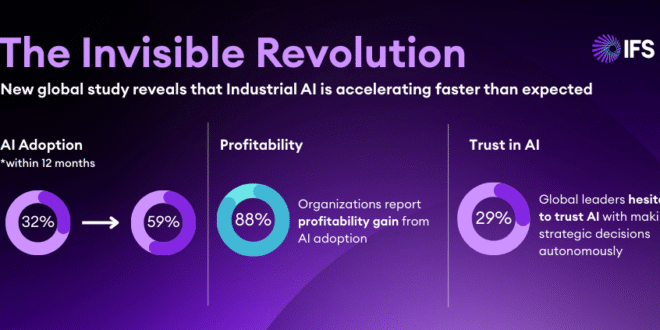

The IFS Invisible Revolution Study 2025* surveyed more than 1,700 senior decision makers at industrial enterprises globally. The research identifies an ‘invisible revolution’: a rapid but under-recognised shift away from consumer productivity-led AI experimentation and toward embedded, operational AI across core business processes. But as with all revolutions, significant challenges in particular an AI Execution Gap are emerging.

The Execution Gap occurs when companies move faster into AI adoption than their staff are able to upskill, as is the case in the EUR industry. The study found that 86% of EUR organisations plan to increase AI investment in 2025, positioning the sector for accelerated adoption and scale. However, reskilling will be critical as 68% believe up to half of their workforce will need retraining. A lack of management understanding of AI (58%) and AI bias in operational decision-making (56%) also remain a top concern for the industry.

“AI is a core driver of business performance, it’s time to plug the ‘AI Execution Gap’—bring people, process, and product together to deliver tangible outcomes,” said Kriti Sharma, CEO, IFS Nexus Black. “The pace of adoption is inspiring, but the next big unlock will come from scaling trust, strategy, and talent. Industrial AI is a powerful force for good, and we’re in a moment of opportunity: those who move fast will lead the next decade of industry.”

The research reveals a striking contrast at the heart of the AI surge. While the technology is already delivering impressive returns, most organisations remain unprepared to scale its impact.

More than half of EUR companies (56%) admit their organisation still lacks a clear AI strategy. Yet the study clearly finds opportunities available to companies that embrace AI. Across the EUR industry, 85% of organisations say AI has already improved profitability, while 67% of EUR firms report higher-than-expected ROI, with 12% achieving more than 25% above expectations. Furthermore, 79% of EUR companies reported higher compliance, the highest across all sectors.

So how do EUR organisations adapt to ensure they stay competitive? Training and upskilling—supporting employees to thrive in an AI-First environment will be key to ensuring that industrial companies remain relevant. While the EUR industry projects the slowest AI transition, the sector is certainly on the right track, with 54% of organisations expecting to be AI-First within a year.

Despite growing confidence in AI’s potential to boost productivity and growth, EUR companies prioritising formalising AI leadership at scale. The study found that 80% of EUR companies expect to create new AI job roles/departments which is the highest across all sectors, with 44% looking to introduce AI officers that are embedded within departments, also the highest of any sector.

The IFS research signals a new stage of enterprise AI, no longer confined to innovation labs, but powering frontline operations. The next 12 months will be decisive as those EUR organisations that close the ‘AI Execution Gap’ now will shape the future of industrial leadership.

Kriti Sharma concluded: “We’re experiencing one of the most profound and underestimated shifts in global business. Industrial AI is here and already reshaping how entire industries run, compete, and grow. The time is now.”

An executive summary of the study is available HERE.

Research conducted by 3Gem in May, 2025.

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer