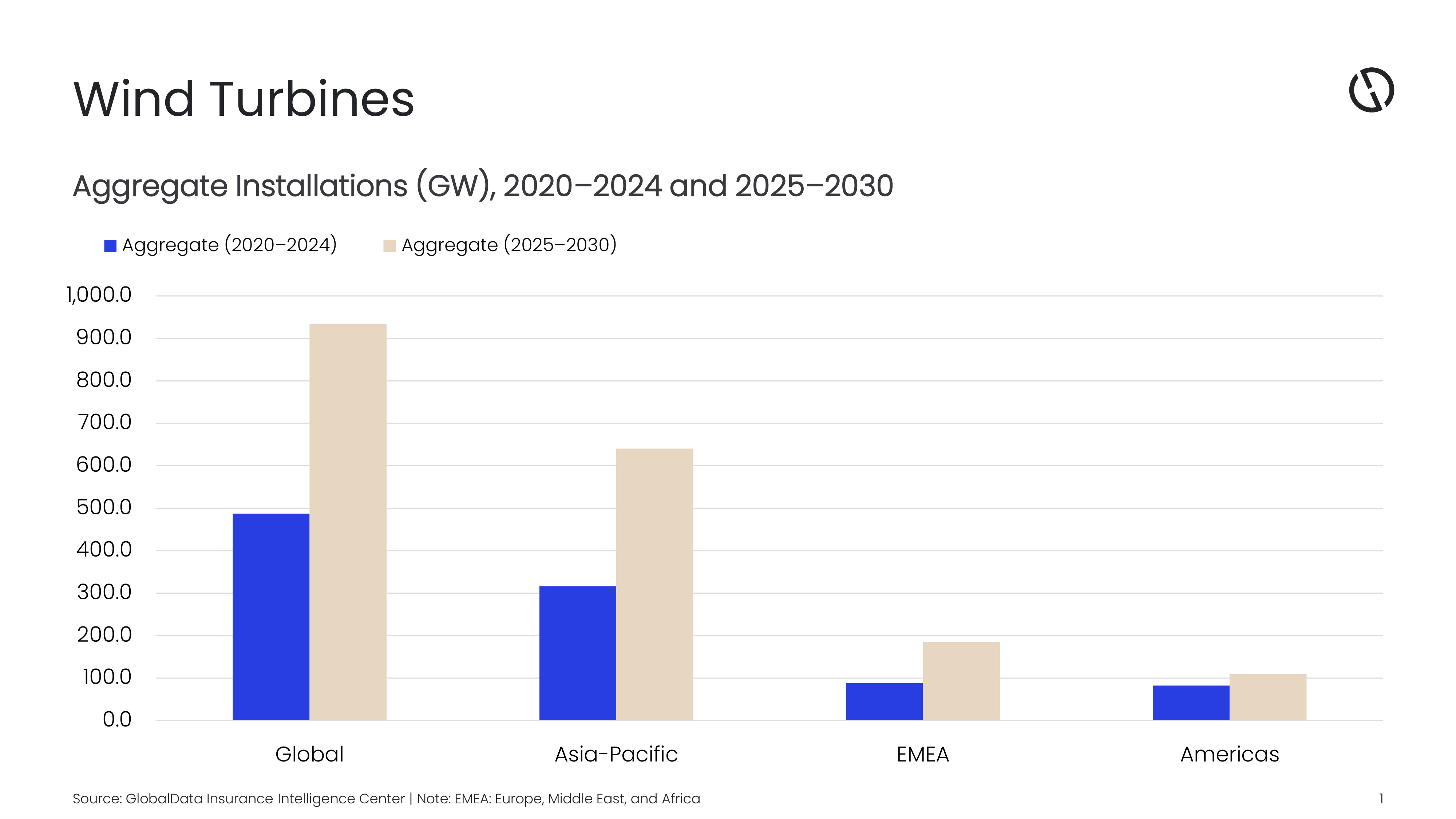

The global wind‑energy market is entering its strongest growth phase to date, driven by accelerating national decarbonization targets, energy‑security needs and long‑term industrial strategies. The aggregate installations are expected to reach 934.6GW in 2030, forecasts GlobalData.

GlobalData’s latest report, Wind Turbines Market Size, Share and Trends Analysis by Technology, Installed Capacity, Generation, Key Players and Forecast, 2024–2030, shows global annual wind‑turbine installations totalled 115.3GW in 2024. Onshore wind accounted for 91.8% of installations, with offshore wind representing the remaining 8.2%.

Bhavana Sri Pullagura, Senior Power Analyst at GlobalData, comments: “The Asia-Pacific (APAC) region leads the global wind turbine market, accounting for the largest share of annual installations and possessing the most advanced manufacturing capabilities for turbines, components, and offshore technologies. APAC’s dominance is primarily driven by China’s extensive onshore and offshore development, India’s rapidly growing domestic manufacturing and auction-driven expansion, and the emerging offshore projects in Japan and Australia.”

Europe, the Middle East, and Africa (EMEA) represents the second-largest market. Europe serves as the regional anchor, bolstered by binding climate mandates under the EU Green Deal, the revised Renewable Energy Directive III, and a strong offshore wind trajectory led by countries in the North Sea.

The Middle East and North Africa are advancing utility-scale renewable energy projects through government-backed procurements and decarbonization initiatives, while certain areas of Sub-Saharan Africa are gradually unlocking wind projects with the help of international financing and regional power pool initiatives.

The Americas ranks as the third-largest market, with the US leading the way, where the Inflation Reduction Act (IRA) has stimulated clean energy manufacturing, repowering activities, and the development of an emerging offshore wind supply chain.

Pullagura adds: “Market share leadership is increasingly concentrated among China’s major original equipment manufacturers (OEMs), supported by cost-efficient manufacturing and unmatched domestic deployment volumes. Meanwhile, European and US manufacturers remain competitive through advanced offshore technology, digital optimization, and robust service portfolios. The current trends such as turbine upscaling, hybrid project integration, and supply chain localization are transforming how and where turbines are produced and deployed.”

The global wind turbine market is on the brink of a new era of accelerated growth, fuelled by increasing clean energy commitments, rapid technological advancements, and more resilient manufacturing ecosystems.

Pullagura concludes: “With Chinese OEMs leading global capacity additions and Western manufacturers driving innovation in offshore and digital turbine platforms, the industry is entering its most competitive and transformative phase to date. As nations ramp up wind deployment to meet climate targets and ensure long-term energy independence, the global wind turbine market is expected to grow significantly, reinforcing wind power’s role as a cornerstone of the world’s renewable energy future.”

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer