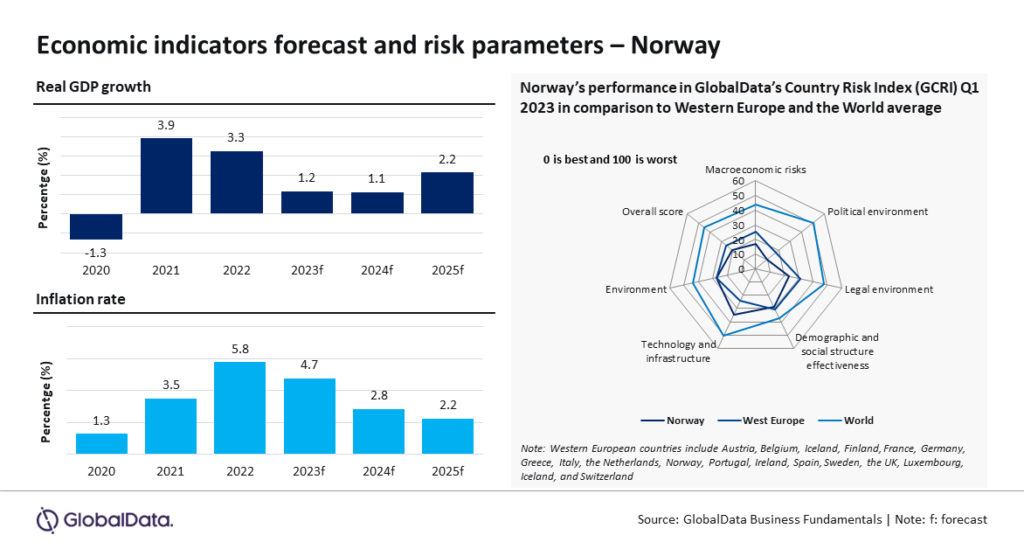

Despite the challenges from the energy crisis faced by several European countries, Norway’s economy exhibited strength in 2022, supported by a sharp increase in its hydrocarbon revenue. However, elevated inflation and tighter monetary policies are anticipated to have a negative impact on private consumption, household spending, and investments in the country, potentially resulting in a deceleration of its economic growth. Against this backdrop, the Norwegian economy is forecast to expand by 1.2% in 2023, compared to a growth rate of 3.3% in 2022, according to GlobalData, the data and analytics company.

GlobalData’s latest report, Macroeconomic Outlook Report: Norway shows that Norway generated approximately $140 billion in revenue from its oil and gas sector in 2022, marking a nearly three-fold increase compared to the previous year. The surge was primarily due to the emergence of Norway as the leading natural gas supplier in Europe following a decrease in Russia’s deliveries. The record revenues were mainly attributed to the substantial rise in European gas prices during the summer, which have stabilised since then.

In the first quarter of 2023, Norway experienced a modest 0.2% quarterly economic growth, recovering from a stagnant period in Q4 2022. This growth was primarily attributed to the revival of petroleum activities and ocean transport, as well as favourable contributions from net external trade. However, the growth was partly offset by declines in household consumption and fixed investments.

Puja Tiwari, Economic Research Analyst at GlobalData, comments: “While revenue from oil and gas is projected to remain robust in 2023, there is a concerning expectation of persistently high inflation, particularly in food prices, which is likely to impact domestic demand. GlobalData predicts a slowdown in the growth of real household consumption expenditure to 1.1% in 2023, compared to the significant growth of 6.5% witnessed in 2022.”

In May 2023, Norway’s annual inflation rate surged to 6.7%, fuelled by increased prices in various sectors such as food, non-alcoholic beverages, housing, utilities, clothing, footwear, and alcoholic beverages. To combat this high inflation, Norges Bank raised its policy rate eight times, totalling 275 basis points, from February 2022 to May 2023, to 3.25%. GlobalData forecasts a moderation in the inflation rate to 4.7% in 2023 from 5.8% in 2022 due to declining energy prices. However, the projected rate remains well above the central bank’s target of around 2%.

Sector-wise, mining, manufacturing, and utilities activities contributed 28.4% to the gross value added (GVA) in 2022, followed by financial intermediation, real estate, and business activities (15.3%), and wholesale, retail, and hotels utilities (7.4%). The three sectors are forecast to grow by 4.1%, 2.9%, and 3.7% in 2023, respectively, according to GlobalData.

On the external side, Norway’s export growth is projected to slow down to 2.5% in 2023 as compared to 12.5% growth in 2022 due to a fall in demand. On the other side, a sharp depreciation of the currency and high inflation are projected to slow down the imports’ growth to 4.6% in 2023 from 14.3% in 2022, according to GlobalData estimates.

Norway is categorised as a very low-risk nation and ranks fourth out of 153 nations in the GlobalData Country Risk Index (GCRI Q1 2023). The country’s risk score is lower in the various parameters, which include macroeconomic, political, legal, demographic, and social structure as well as environment when compared to the average of West Europe nations in Q1 2023.

Tiwari concludes: “In order to sustain high levels of gas production, Norway is committed to investing in new resources and enhancing the recovery from existing facilities. By allocating a substantial investment of $30 billion to develop new offshore fields, Norway anticipates maintaining its current robust gas production until 2026. This strategic investment will solidify its reputation as a reliable long-term energy provider to Europe while also supporting the country’s economic advancement in the years ahead.”

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer