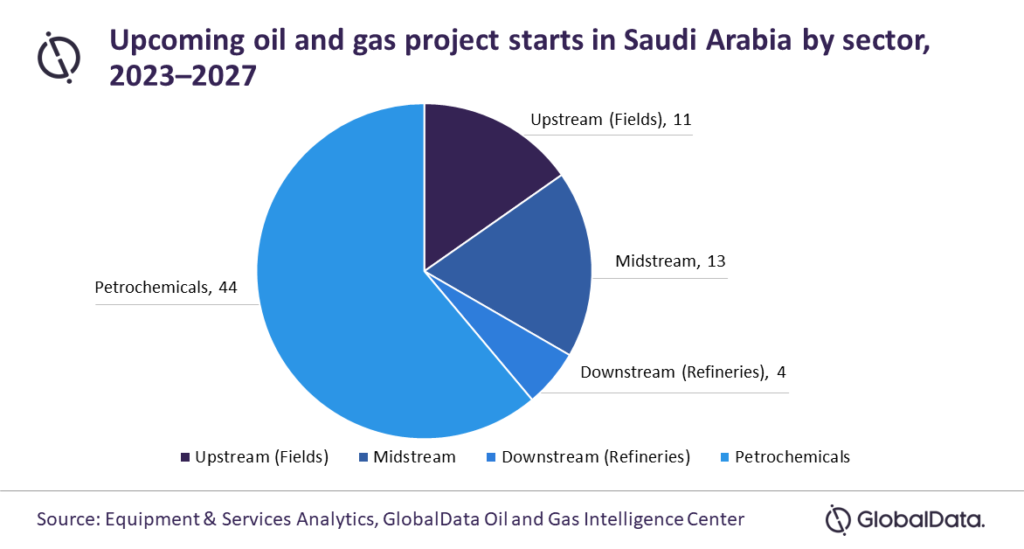

Petrochemical projects will constitute the majority of the upcoming oil and gas projects that are expected to commence operations in Saudi Arabia during the period 2023 to 2027, accounting for around 61% of the total projects, says GlobalData, the data, and analytics company.

GlobalData’s report, Middle East Oil and Gas Projects Analytics and Forecast by Project Type, Sector, Countries, Development Stage, Capacity and Cost, 2023-2027, reveals that petrochemical projects are expected to witness the highest project starts in Saudi Arabia (44), followed by midstream (13), upstream (fields) and refineries with 11 and four, respectively. Of the 44 petrochemical projects that are expected to start operations in the country by 2027, 36 are likely to be new builds and the remaining are expansion projects.

Himani Pant Pandey, Oil & Gas Analyst at GlobalData, comments: “Petrochemicals continue to gain prominence in Saudi Arabia as part of its liquids to chemicals strategy, which is aimed at reducing dependence on the upstream sector, diversify its economy, and create additional employment opportunities. The country has huge potential to convert its liquids into chemicals through advanced technologies and support a viable circular economy.”

Among upcoming petrochemical projects in Saudi Arabia by 2027, Saudi Aramco Total Refining and Petrochemical Company Al-Jubail Ethylene Plant is a major project with a capacity of 1.50 mtpa and costing $2.7 billion. The plant will provide feedstock to other petchem and specialty companies in the Jubail industrial city.

Pandey concludes: “The state-owned companies of Suadi Arabia and China – SABIC, Aramco, and Sinopec – have recently announced plans to increase their collaboration in refinery and petrochemicals sectors. The collaboration helps to further advance the downstream sector in both the countries and provides a stable market for Saudi Arabia for its oil and petrochemicals.”

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer