The US military raid in Venezuela on January 3, 2026, resulted in President Nicolás Maduro’s capture, which has sharply heightened geopolitical tensions at the start of 2026. Oil, gold, silver, the US dollar, and global equities are expected to react immediately as investors reprice political and supply-chain risk. Venezuela’s large energy and gold endowments, combined with heightened market sensitivity after strong gains in 2025, raise the likelihood of outsized, fast-moving swings across key asset classes, says GlobalData.

The near-term political backdrop inside Venezuela remains fragile. A temporary president has assumed control amid heightened uncertainty over security, institutional continuity, and the direction of economic policy. At the same time, the US President Donald Trump has issued warnings to the new interim leadership, reinforcing the risk that the situation evolves not only through domestic politics but also through external pressure and rapidly shifting policy stances. For markets, that combination increases the probability of sudden changes in trade access, operational continuity, and enforcement intensity around financial and commercial channels.

Ramnivas Mundada, Director of Economic Research and Companies at GlobalData, comments: “From a macroeconomic perspective, the most direct global transmission channel remains energy. Venezuela is still highly dependent on hydrocarbon export receipts for foreign exchange and fiscal capacity. Even without major physical damage to fields or terminals, oil flows can be disrupted by softer but powerful mechanisms such as higher insurance costs, shipping caution, payment frictions, and counterparties stepping back due to compliance uncertainty. In such episodes, delivered energy costs can rise faster than headline benchmarks, while heavy crude and refined product markets, particularly diesel and jet fuel, can show early signs of tightening.”

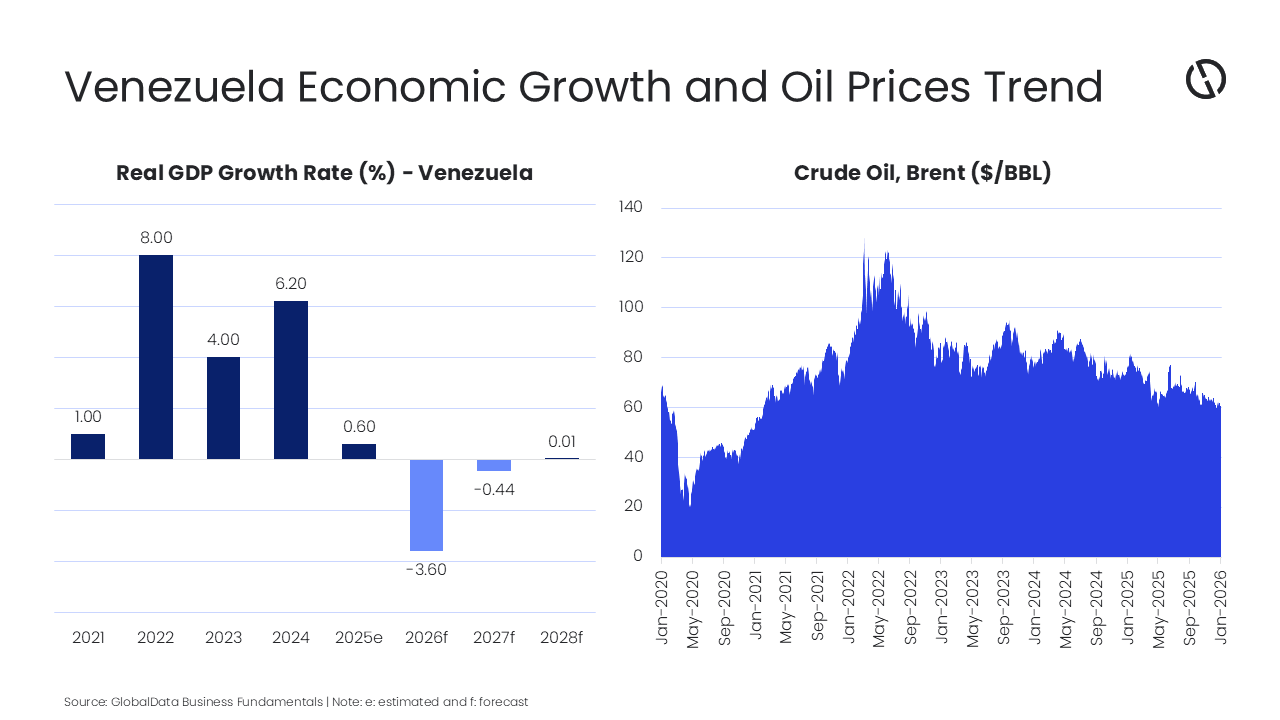

With Brent at $60.57/bbl as of January 05, 2026, the initial market reaction is likely to be driven more by uncertainty and risk premia than by confirmed barrel losses. The key question in the next few days of trading will be whether evidence emerges that exports and logistics remain broadly intact, or whether shipping, insurance, and payments begin to constrain flows. In addition to crude, precious metals may attract safe-haven demand, while the US dollar can strengthen if risk sentiment deteriorates, both of which can amplify inflation pressure in oil-importing emerging markets through currency depreciation.

Within Venezuela, the short-run economic impact is likely to be negative even if oil production is not immediately impaired. GlobalData projects that the Venezuelan economy to contract by 3.6% in 2026, following an estimated 0.6% growth in 2025. Heightened political uncertainty can slow activity through reduced business confidence, disrupted domestic logistics, and tighter access to trade finance and imported inputs. Inflation risks skew upward in the near term if the currency weakens or if supply bottlenecks re-emerge for fuel, food, and essential imports.

Over the full year, Venezuela’s GDP growth outlook becomes more binary: a rapid stabilization of governance and trade channels could limit the damage and support a gradual normalization, but prolonged uncertainty or additional external restrictions would raise the risk of renewed contraction, higher inflation, and deeper pressures on household purchasing power and public finances.

For corporates globally, spillovers are most likely to appear through inflation and financial conditions rather than direct exposure to Venezuela. Higher energy and freight costs tend to lift headline inflation and can influence interest-rate expectations, affecting funding costs and discretionary demand. Sector sensitivity will vary. Autos are exposed through consumer purchasing power and financing conditions as well as petrochemical-linked inputs and logistics. Mining is directly sensitive to diesel-intensive operations and bulk freight costs. Power utilities face differing exposure depending on fuel mix and regulation, while still remaining sensitive to inflation-driven rate volatility.

Financials are most exposed to market volatility, credit conditions, and emerging market repricing. Consumer and manufacturing companies are likely to feel the impact through freight, packaging and energy inputs, with outcomes depending on near-term pass-through ability.

Mundada continues: “Markets tend to reprice geopolitical risk quickly at the open and then re-evaluate as operational signals emerge. The immediate issue is whether this remains primarily a volatility event or evolves into a sustained disruption that tightens energy and logistics conditions and feeds into inflation expectations.”

Mundada concludes: “In the coming sessions, investors and corporate risk teams are expected to closely watch indicators of real-economy disruption, including shipping activity, freight and insurance costs, payment and settlement conditions, and early signs of tightening in refined product markets. Whether these signals stabilise quickly or deteriorate over subsequent weeks will shape the persistence of the market reaction through the first quarter of 2026.”

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer