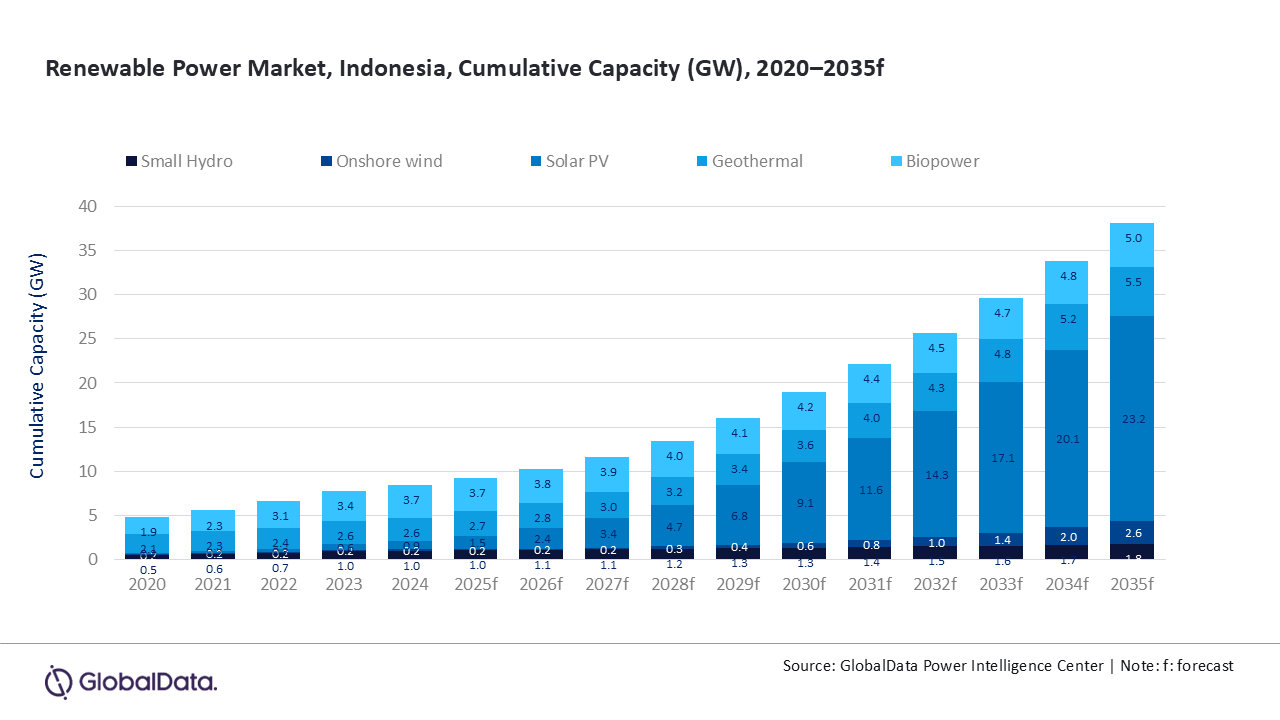

Indonesia is advancing its clean energy transition while maintaining a strong reliance on thermal generation, supported by major investments in solar PV, onshore wind, and geothermal energy. The country’s cumulative renewable power capacity is projected to reach 38.1GW by 2035, up from 8.4GW in 2024, registering a compound annual growth rate (CAGR) of 14.7% during 2024–35, says GlobalData, the data and analytics company.

GlobalData’s report, Indonesia Power Market Trends and Analysis by Capacity, Generation, Transmission, Distribution, Regulations, Key Players and Forecast to 2035, shows that solar PV and onshore wind will drive Indonesia’s renewable growth, supported by evolving policy and investment frameworks under the National Energy Policy (KEN), RUPTL 2025–2034, and Presidential Regulation 112/2022.

Solar PV capacity of Indonesia is forecast to surge from 0.9GW in 2024 to 23.2GW in 2035, driven by the expansion of floating and utility-scale projects and rooftop solar programs supported by feed-in mechanisms and updated net-metering regulations. Onshore wind will also record substantial growth, rising from 0.15GW to 2.6GW by 2035, underpinned by competitive tenders and hybrid renewable developments in Sulawesi and East Nusa Tenggara. Geothermal power will expand steadily from 2.6GW to 5.5GW, leveraging Indonesia’s vast geothermal potential and strong fiscal support through the PT SMI Geothermal Fund.

Mohammed Ziauddin, Power Analyst at GlobalData, comments: “Indonesia’s renewable expansion is being catalyzed by national frameworks such as the Just Energy Transition Partnership (JETP), which targets 44% renewable electricity by 2030, alongside fiscal and investment incentives under RUPTL 2025–2034. These measures are complemented by regulatory clarity under Presidential Regulation 112/2022, which limits new coal development and strengthens renewables integration. The ongoing expansion of cross-island transmission and the deployment of digital grid systems will be key to supporting this scale-up.”

Despite strong growth in renewables, Indonesia’s power system will remain heavily reliant on thermal sources through 2035. This sustained dependence reflects the country’s abundant domestic coal reserves, affordability considerations, and the critical role of gas in maintaining grid stability and meeting rising electricity demand.

Coal-fired capacity is expected to rise from 55.6GW in 2024 to 61.4GW in 2035, supported by existing contracts and state-owned infrastructure, while gas-fired capacity will increase from 29.1GW to 36GW to provide flexibility and backup for intermittent renewables. For a geographically dispersed nation with isolated island grids, thermal generation continues to offer reliability and cost stability as renewable infrastructure and storage systems expand.

Zia concludes: “Indonesia’s power system is entering a dual-track phase of expansion, scaling renewables while retaining thermal stability. With solar PV and wind onshore leading growth, supported by geothermal development and grid modernisation, the country is progressively building a more diversified and secure energy mix through 2035 and beyond.”

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer