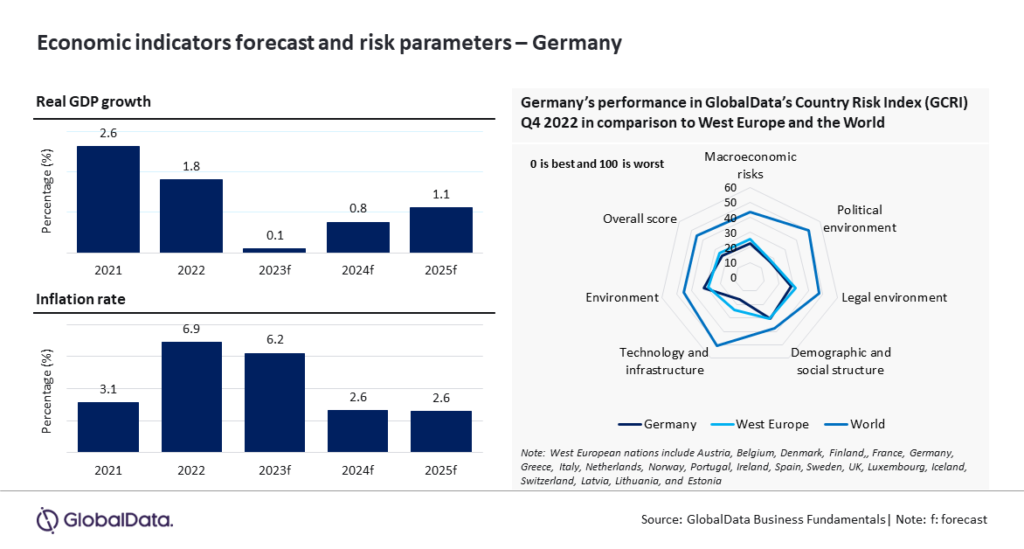

The persistent inflationary pressures in Germany are still impacting the consumer spending and domestic demand. Moreover, the subdued outlook for external demand is expected to further dampen trade prospects. Considering these circumstances, the country’s economic growth is set to decelerate from 1.8% in 2022 to 0.1% in 2023. Nevertheless, there are encouraging developments in the industrial sector, as supply bottlenecks are gradually easing, and energy prices are declining. As a result, there will be a slight improvement with a projected real GDP growth of 0.8% in 2024, forecasts GlobalData, the data and analytics company.

GlobalData’s latest report, Macroeconomic Outlook Report: Germany, reveals that the imposition of sanctions on Russia severely affected the German economy, as it was the largest European buyer of Russian oil and gas. The consequences included disruptions in the supply chain, high energy prices, increased construction costs, deteriorating financial conditions, and a decline in disposable income.

In Q1 2023, Germany’s real GDP growth remained stagnant following a revised 0.5% contraction in Q4 2022. Two out of the four quarters of 2022 saw a contraction in real GDP.

Sadaf Ambari, Economic Research Analyst at GlobalData, comments, “Germany’s industrial output contracted by an average of 2.2% during March to July 2022 but recovered with an average growth rate of 1.2% from August to December 2022. In the first two months of 2023, it experienced a modest 0.5% increase. The positive trend in the industrial output from August 2022 onwards and a significant growth of 4.8% in German industrial orders in February 2023, as reported by the federal statistics office, was influenced by the declining energy prices (above 30% during Q2 to Q4 2022 to 15.7% in Q1 2023).”

Sector-wise, financial intermediation, real estate, and business activities contributed 25.7% to the gross value added (GVA) in 2022, followed by the mining, manufacturing, and utilities (23.4%), and wholesale, retail trade and hotels (11.5%). According to GlobalData, in nominal terms, the three sectors are forecast to grow by 4.8%, 4.8% and 5.4% in 2023, respectively, compared to 5.6%, 5.6%, and 6.3% in 2022.

Germany’s economic growth is significantly challenged by high inflation, which soared from 3.1% in 2021 to 6.9% in 2022. It is anticipated to remain elevated at 6.2% in 2023, surpassing the ECB’s 2% target. To address this, the ECB has increased its key policy rate seven times, totalling 375 basis points, from June 2022 to May 2023.

GlobalData predicts a contraction of 0.7% in real household consumption expenditure for 2023, influenced by a higher inflation rate excluding food and energy (5.8% in Q1 2023 compared to 2.9% in Q1 2022) and the rise in food prices (20.4% compared to 5.3%).

On the external side, GlobalData projects German exports to experience a slower growth rate of 2.6% in 2023, in contrast to the average growth of 10.7% observed during 2021-22. Similarly, imports are also expected to grow at a slower pace of 5.6% in 2023, compared to an average of 14% over the past two years. This deceleration in imports can be attributed to currency depreciation and reduced disposable income.

Germany’s low-risk profile, ranking 12th out of 153 nations in the GlobalData Country Risk Index (GCRI Q4 2022), reflects its resilience and stability amidst economic challenges. The country’s risk score is lower in the parameters of macroeconomics, political, legal, technology and infrastructure and legal risk when compared to the average of West European nations.

After the import ban on Russian oil in December 2022, the share of Russia oil in total oil imports of Germany plummeted from 36.5% in January 2022 to a mere 0.1% in January 2023. Germany successfully mitigated this decline by diversifying its oil imports from countries such as Norway, the UAE, the UK, the US, and Kazakhstan.

Ambari concludes: “Germany’s shift towards renewable energy and diversification of oil imports has not only mitigated the impact of the ban on Russian oil imports but also sets a path toward a less fossil fuel-dependent economy. By prioritising renewables and reducing bureaucratic obstacles in renewable energy production, Germany has the potential to build a sustainable and resilient energy sector for the future.”

Engineer News Network The ultimate online news and information resource for today’s engineer

Engineer News Network The ultimate online news and information resource for today’s engineer